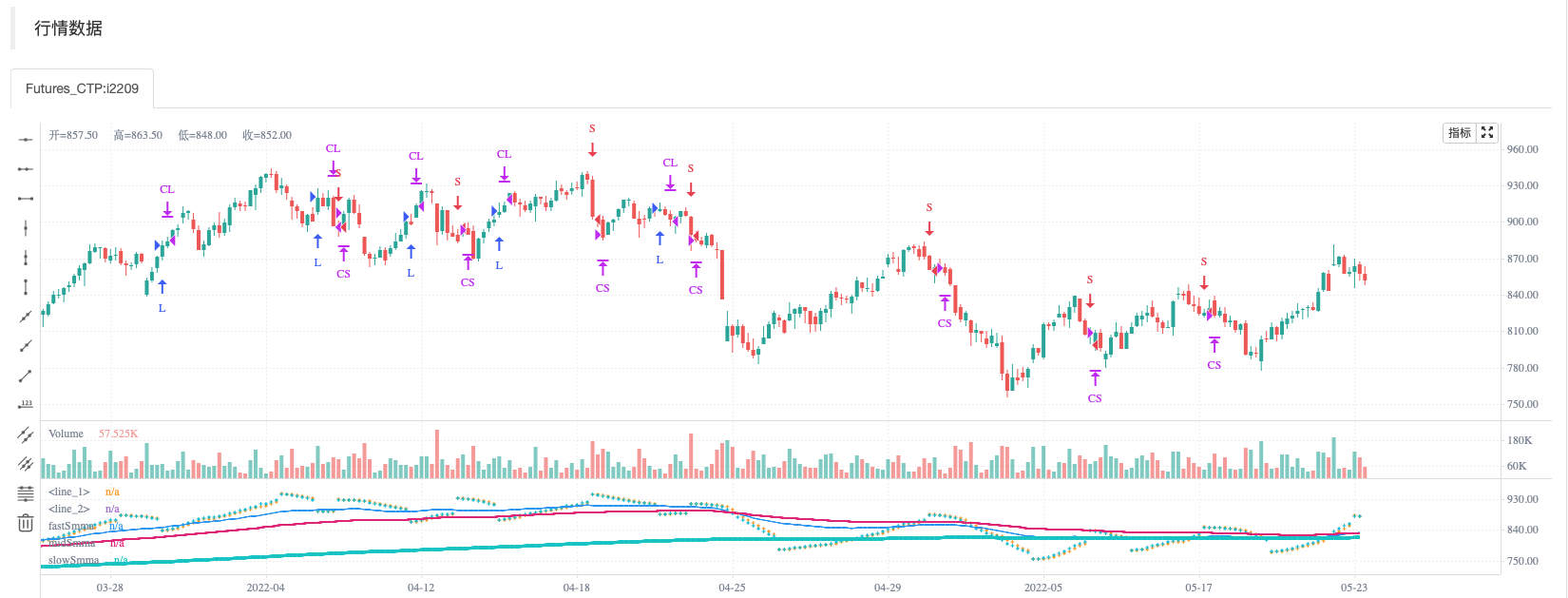

此脚本是SAR策略和3个平滑移动平均值的组合。

策略: 当所有3个SMMA都上升时,需要SAR多头。当所有3个SMMA都下降时,做空SAR。支持StopLoss和TakeProfit。

回测测试

策略源码

/*backtest

start: 2021-12-01 00:00:00

end: 2022-05-24 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

args: [["ContractType","i2209",360008]]

*/

//@version=5

//strategy(title="SAR + 3SMMA with SL & TP", overlay=true, calc_on_order_fills=false, calc_on_every_tick=false, default_qty_type=strategy.percent_of_equity, default_qty_value=100, currency=currency.USD, commission_type= strategy.commission.percent, commission_value=0.03)

start = input.float(0.02, step=0.01, group="SAR", title="开始")

increment = input.float(0.02, step=0.01, group="SAR", title="增量")

maximum = input.float(0.2, step=0.01, group="SAR", title="最大值")

//Take Profit Inputs

take_profit = input.float(title="止盈 (%)", minval=0.0, step=0.1, defval = 0.1, group="止损和止盈", inline="TP") * 0.01

//Stop Loss Inputs

stop_loss = input.float(title="止损 (%)", minval=0.0, step=0.1, defval=1, group="止损和止盈", inline="SL") * 0.01

// Smooth Moving Average

fastSmmaLen = input.int(21, minval=1, title="快线周期", group = "SMA")

midSmmaLen = input.int(50, minval=1, title="中线周期", group = "SMA")

slowSmmaLen = input.int(200, minval=1, title="慢线周期", group = "SMA")

src = input(close, title="数据源", group = "SMA")

smma(ma, src, len) =>

smma = 0.0

smma := na(smma[1]) ? ma : (smma[1] * (len - 1) + src) / len

smma

fastSma = ta.sma(src, fastSmmaLen)

midSma = ta.sma(src, midSmmaLen)

slowSma = ta.sma(src, slowSmmaLen)

fastSmma = smma(fastSma, src, fastSmmaLen)

midSmma = smma(midSma, src, midSmmaLen)

slowSmma = smma(slowSma, src, slowSmmaLen)

isSmmaUpward = ta.rising(fastSmma, 1) and ta.rising(midSmma, 1) and ta.rising(slowSmma, 1)

var bool uptrend = na

var float EP = na

var float SAR = na

var float AF = start

var float nextBarSAR = na

if bar_index > 0

firstTrendBar = false

SAR := nextBarSAR

if bar_index == 1

float prevSAR = na

float prevEP = na

lowPrev = low[1]

highPrev = high[1]

closeCur = close

closePrev = close[1]

if closeCur > closePrev

uptrend := true

EP := high

prevSAR := lowPrev

prevEP := high

else

uptrend := false

EP := low

prevSAR := highPrev

prevEP := low

firstTrendBar := true

SAR := prevSAR + start * (prevEP - prevSAR)

if uptrend

if SAR > low

firstTrendBar := true

uptrend := false

SAR := math.max(EP, high)

EP := low

AF := start

else

if SAR < high

firstTrendBar := true

uptrend := true

SAR := math.min(EP, low)

EP := high

AF := start

if not firstTrendBar

if uptrend

if high > EP

EP := high

AF := math.min(AF + increment, maximum)

else

if low < EP

EP := low

AF := math.min(AF + increment, maximum)

if uptrend

SAR := math.min(SAR, low[1])

if bar_index > 1

SAR := math.min(SAR, low[2])

else

SAR := math.max(SAR, high[1])

if bar_index > 1

SAR := math.max(SAR, high[2])

nextBarSAR := SAR + AF * (EP - SAR)

sarIsUpTrend = uptrend ? true : false

sarFlippedDown = sarIsUpTrend and not sarIsUpTrend[1] ? true : false

sarFlippedUp = not sarIsUpTrend and sarIsUpTrend[1] ? true : false

longEntryCondition = isSmmaUpward and sarFlippedDown

shortEntryCondition = not isSmmaUpward and sarFlippedUp

if(longEntryCondition)

strategy.entry("L", strategy.long, stop=nextBarSAR, comment="L")

if(shortEntryCondition)

strategy.entry("S", strategy.short, stop=nextBarSAR, comment="S")

strategy.exit("CL", when=strategy.position_size > 0, limit=strategy.position_avg_price * (1+take_profit), stop=strategy.position_avg_price*(1-stop_loss))

strategy.exit("CS", when=strategy.position_size < 0, limit=strategy.position_avg_price * (1-take_profit), stop=strategy.position_avg_price*(1+stop_loss))

plot(SAR, style=plot.style_cross, linewidth=1, color=color.orange)

plot(nextBarSAR, style=plot.style_cross, linewidth=1, color=color.aqua)

plot(series = fastSmma, title="fastSmma", linewidth=1)

plot(series = midSmma, title="midSmma", linewidth=2)

plot(series = slowSmma, title="slowSmma", linewidth=3)

// plotchar(series=isSmmaUpward, title="isSmmaUpward", char='')

// plotchar(series=sarIsUpTrend, title="sarIsUpTrend", char='')

// plotchar(series=sarFlippedUp, title="sarFlippedUp", char='')

// plotchar(series=sarFlippedDown, title="sarFlippedDown", char='')

// plotchar(series=longEntryCondition, title="longEntryCondition", char='')

// plotchar(series=shortEntryCondition, title="shortEntryCondition", char='')

// plotchar(series=strategy.position_size > 0, title="inLong", char='')

// plotchar(series=strategy.position_size < 0, title="inShort", char='')

//plot(strategy.equity, title="equity", color=color.red, linewidth=2, style=plot.style_areabr)

相关推荐