该策略基于RSI和ATR波段,在5分钟和15分钟的时间范围内效果更好。我还添加了65和21均线的黄金交叉点,以确认趋势。

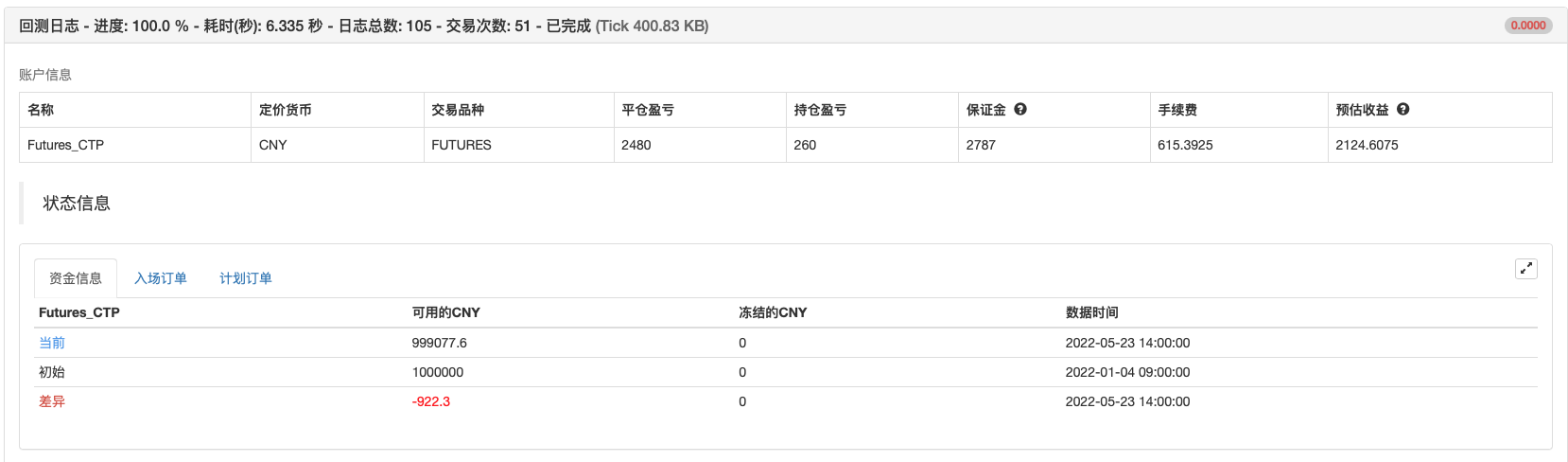

回测测试

策略源码

/*backtest

start: 2022-01-01 09:00:00

end: 2022-05-23 15:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

args: [["ContractType","rb888",360008]]

*/

//@version=4

strategy("Super Scalper - 5 Min 15 Min", overlay=true)

source = close

atrlen = input(14, "ATR周期")

mult = input(1, "ATR乘数", step=0.1)

smoothing = input(title="ATR Smoothing", defval="RMA", options=["RMA", "SMA", "EMA", "WMA"])

ma_function(source, atrlen) =>

if smoothing == "RMA"

rma(source, atrlen)

else

if smoothing == "SMA"

sma(source, atrlen)

else

if smoothing == "EMA"

ema(source, atrlen)

else

wma(source, atrlen)

atr_slen = ma_function(tr(true), atrlen)

upper_band = atr_slen * mult + close

lower_band = close - atr_slen * mult

// Create Indicator's

shortSMA = ema(close, 21)

longSMA = ema(close, 65)

rsi = rsi(close, 14)

atr = atr(14)

// Specify conditions

longCondition = open < lower_band

shortCondition = open > upper_band

GoldenLong = crossover(shortSMA,longSMA)

Goldenshort = crossover(longSMA,shortSMA)

plotshape(shortCondition, title="Sell Label", text="Sell", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.red, textcolor=color.white, transp=0)

plotshape(longCondition, title="Buy Label", text="Buy", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.green, textcolor=color.white, transp=0)

plotshape(Goldenshort, title="Golden Sell Label", text="Golden Crossover Short", location=location.abovebar, style=shape.labeldown, size=size.tiny, color=color.blue, textcolor=color.white, transp=0)

plotshape(GoldenLong, title="Golden Buy Label", text="Golden Crossover Long", location=location.belowbar, style=shape.labelup, size=size.tiny, color=color.yellow, textcolor=color.white, transp=0)

// Execute trade if condition is True

if (longCondition)

stopLoss = low - atr * 2

takeProfit = high + atr * 5

strategy.entry("long", strategy.long, when = rsi > 50)

else if (shortCondition)

stopLoss = high + atr * 2

takeProfit = low - atr * 5

strategy.entry("short", strategy.short, when = rsi < 50)

// Plot ATR bands to chart

////ATR Up/Low Bands

plot(upper_band)

plot(lower_band)

// Plot Moving Averages

plot(shortSMA, color = color.red)

plot(longSMA, color = color.yellow)

相关推荐