商品期货多品种R-Breaker策略

创建于: 2021-09-26 14:10:58,

更新于:

2024-11-27 21:16:46

0

0

1676

1676

商品期货多品种R-Breaker策略

R-Breaker是一种短线日内策略,因为策略没有用到指标,没有指标周期之类的参数。策略的触发条件完全是通过价格计算出来的支撑线、阻力线。避开了指标参数对于行情的拟合问题,并且模型原理非常简单,对于市场各种行情适应性较强。虽然说策略实盘不一定效果出众,但是也可以作为一个学习研究方向思考策略设计。

策略原理

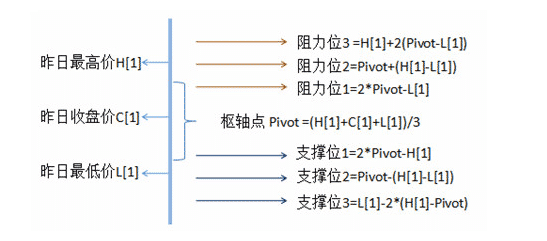

- 支撑线、阻力线算法 计算这些数据的时候用到三个数据分别是: 1、上一根日线BAR的最高价。 2、上一根日线BAR的收盘价。 3、上一根日线BAR的最低价。

这些数据非常好获取。

var r = exchange.GetRecords(PERIOD_D1) // 获取K线数据

var preBar = r[r.length - 2] // 上一根日线BAR

var preHigh = preBar.High // 上一根日线BAR最高价

var preClose = preBar.Close // 上一根日线BAR收盘价

var preLow = preBar.Low // 上一根日线BAR最低价

然后计算阻力价、支撑价。

var pivot = (preHigh + preLow + preClose) / 3 // 中线

var resistancePrice1 = 2 * pivot - preLow // 阻力价1

var resistancePrice2 = pivot + (preHigh - preLow) // 阻力价2

var resistancePrice3 = preHigh + 2 * (pivot - preLow) // 阻力价3

var strutPrice1 = 2 * pivot - preHigh // 支撑价1

var strutPrice2 = pivot - (preHigh - preLow) // 支撑价2

var strutPrice3 = preLow - 2 * (preHigh - pivot) // 支撑价3

图解:

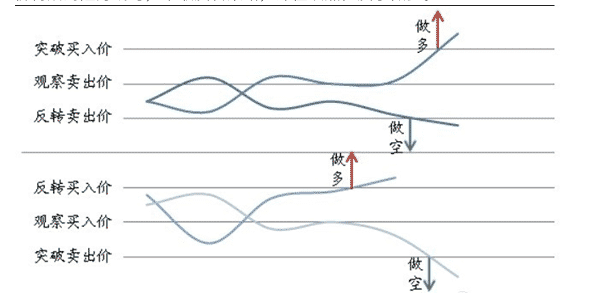

- 触发交易

- 突破 在空仓条件下,如果盘中价格超过突破买入价,则采取趋势策略,即在该点位开仓做多。 在空仓条件下,如果盘中价格跌破突破卖出价,则采取趋势策略,即在该点位开仓做空。

- 反转

持多单,当日内最高价超过观察卖出价后,盘中价格出现回落,且进一步跌破反转卖出价构成的支撑线时,采取反转策略,即在该点位反手做空。

持空单,当日内最低价低于观察买入价后,盘中价格出现反弹,且进一步超过反转买入价构成的阻力线时,采取反转策略,即在该点位反手做多。

- 收盘 下午收盘平仓。

图解:

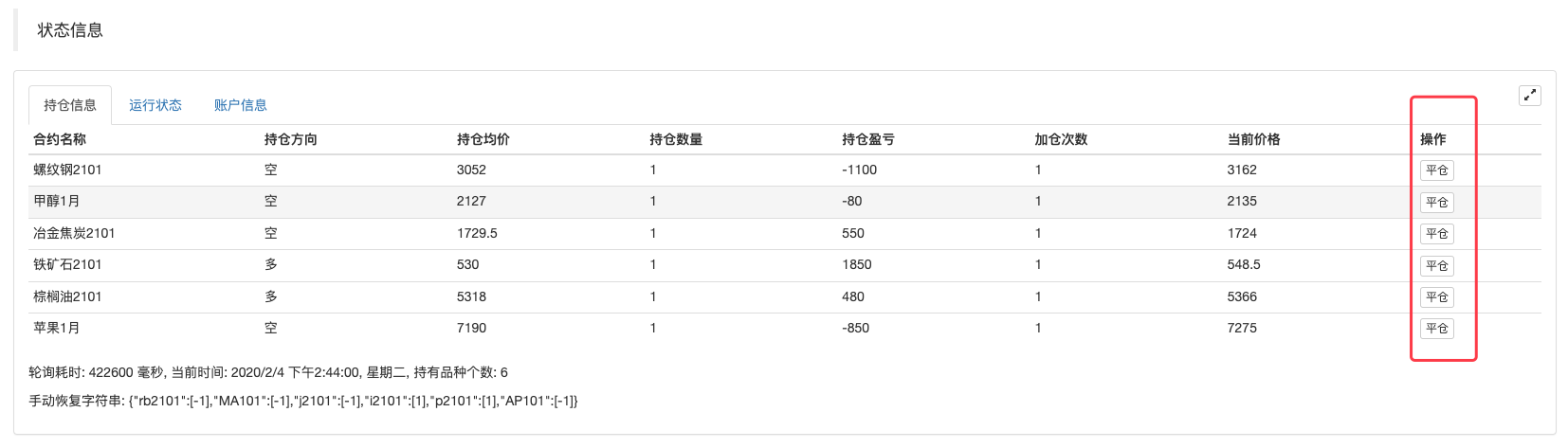

设计为多品种策略

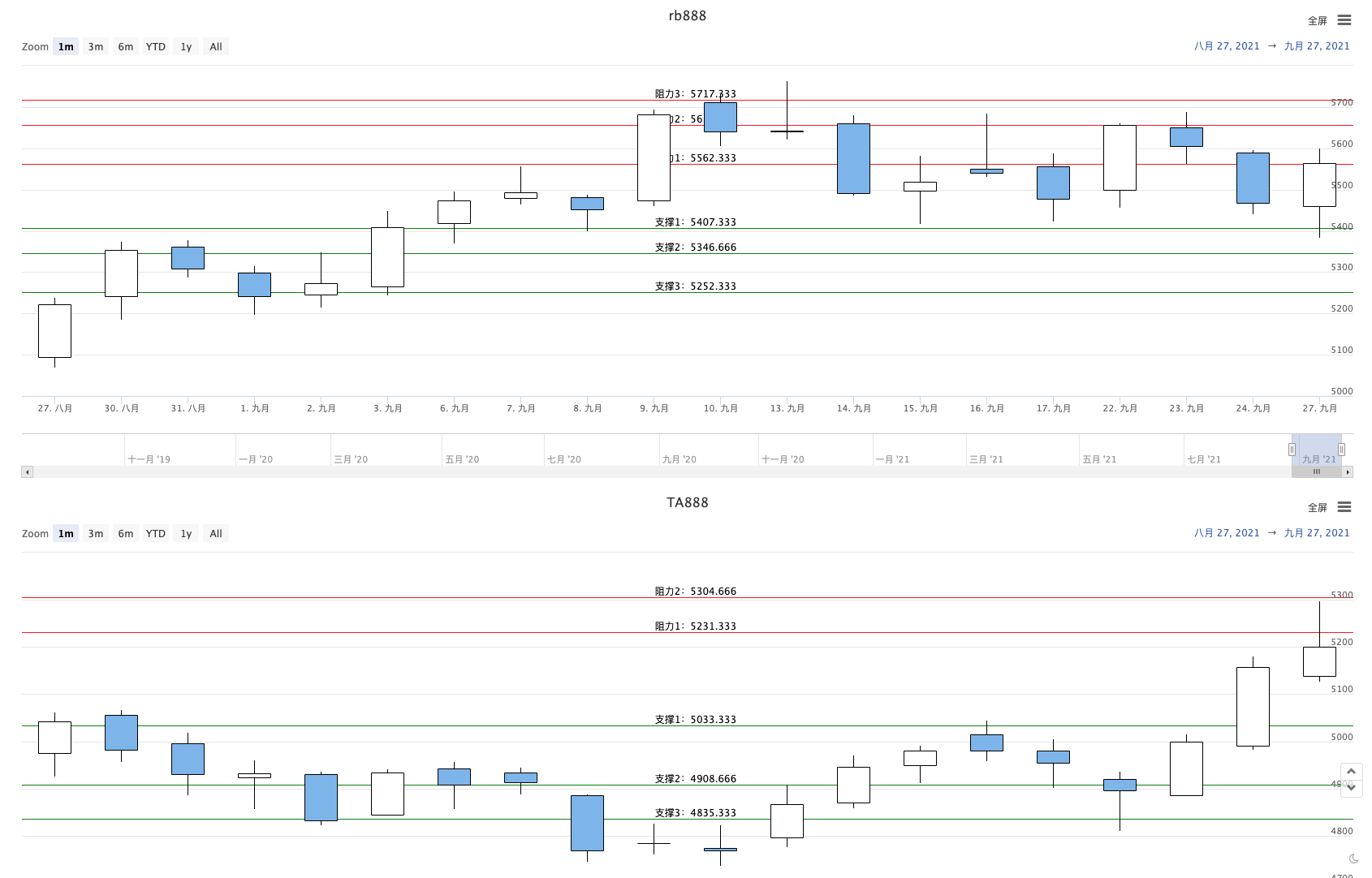

我们采用和之前文库中的一篇文章「商品期货多品种均线策略」中一样的程序架构。把均线模型替换成R-Breaker模型。但是增加一些其它扩展,给每个品种增加图表显示,显示支撑线、阻力线。给每个品种增加一个交互按钮,可以在盘中手动平仓。

策略源码

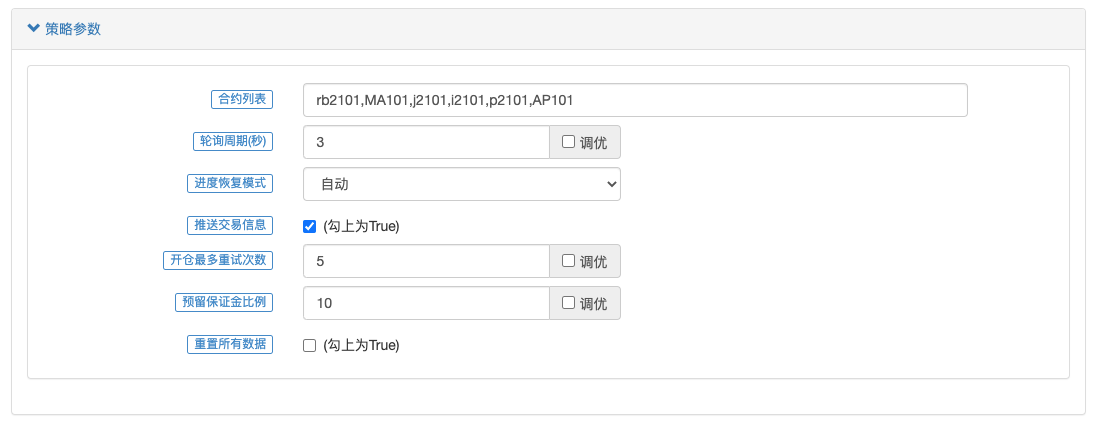

策略参数很少,策略本身逻辑的参数一个也没有。

合约列表中的合约代码参数以英文逗号间隔,例如:rb2101,MA101,j2101,i2101,p2101,AP101。这样策略就针对这些合约品种操作。

/*backtest

start: 2021-06-01 09:00:00

end: 2021-09-25 15:00:00

period: 1d

basePeriod: 5m

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

args: [["Instruments","rb2201,MA201,j2201,i2201,p2201,AP201"]]

*/

// 类库交易对象

var _bot = $.NewPositionManager()

// 画图相关全局变量

var arrChart = []

var Index = 0

var Manager = {

New: function(needRestore, symbol, keepBalance, index) {

var symbolDetail = _C(exchange.SetContractType, symbol)

if (symbolDetail.VolumeMultiple == 0 || symbolDetail.MaxLimitOrderVolume == 0 || symbolDetail.MinLimitOrderVolume == 0 || symbolDetail.LongMarginRatio == 0 || symbolDetail.ShortMarginRatio == 0) {

Log(symbolDetail)

throw "合约信息异常"

} else {

Log("合约", symbolDetail.InstrumentName, "一手", symbolDetail.VolumeMultiple, "份, 最大下单量", symbolDetail.MaxLimitOrderVolume, "保证金率:", _N(symbolDetail.LongMarginRatio), _N(symbolDetail.ShortMarginRatio), "交割日期", symbolDetail.StartDelivDate)

}

// 声明枚举量

var ACT_IDLE = 0

var ACT_LONG = 1

var ACT_SHORT = 2

var ACT_COVER = 3

var ERR_SUCCESS = 0

var ERR_SET_SYMBOL = 1

var ERR_GET_ORDERS = 2

var ERR_GET_POS = 3

var ERR_TRADE = 4

var ERR_GET_DEPTH = 5

var ERR_NOT_TRADING = 6

var errMsg = ["成功", "切换合约失败", "获取订单失败", "获取持仓失败", "交易下单失败", "获取深度失败", "不在交易时间"]

// 构造对象

var obj = {

symbol: symbol,

keepBalance: keepBalance,

}

// 初始化任务对象

obj.task = {

action: ACT_IDLE,

amount: 0,

dealAmount: 0,

avgPrice: 0,

preCost: 0,

preAmount: 0,

init: false,

retry: 0,

desc: "空闲",

onFinish: null

}

obj.lastPrice = 0

obj.symbolDetail = symbolDetail

// 策略运行时数据

obj.currHigh = null

obj.currLow = null

obj.pivot = null

obj.resistancePrice1 = null

obj.resistancePrice2 = null

obj.resistancePrice3 = null

obj.strutPrice1 = null

obj.strutPrice2 = null

obj.strutPrice3 = null

obj.records = null

obj.index = index

obj.preBarTime = 0

obj.backhand = 0

obj.isBannedTrade = false

// 持仓状态信息

obj.status = {

symbol: symbol,

recordsLen: 0,

vm: [],

open: 0,

cover: 0,

st: 0,

marketPosition: 0,

lastPrice: 0,

holdPrice: 0,

holdAmount: 0,

holdProfit: 0,

symbolDetail: symbolDetail,

lastErr: "",

lastErrTime: "",

// 可以增加一些显示的数值属性

currHigh: null,

currLow: null,

pivot: null,

resistancePrice1: null,

resistancePrice2: null,

resistancePrice3: null,

strutPrice1: null,

strutPrice2: null,

strutPrice3: null,

isTrading: false

}

// 设置错误的功能函数

obj.setLastError = function(err) {

if (typeof(err) === 'undefined' || err === '') {

obj.status.lastErr = ""

obj.status.lastErrTime = ""

return

}

var t = new Date()

obj.status.lastErr = err

obj.status.lastErrTime = t.toLocaleString()

}

// 恢复函数

obj.reset = function(marketPosition) {

if (typeof(marketPosition) !== 'undefined') {

obj.marketPosition = marketPosition

var pos = _bot.GetPosition(obj.symbol, marketPosition > 0 ? PD_LONG : PD_SHORT)

if (pos) {

obj.holdPrice = pos.Price

obj.holdAmount = pos.Amount

Log(obj.symbol, "仓位", pos)

} else {

throw "恢复" + obj.symbol + "的持仓状态出错, 没有找到仓位信息"

}

Log("恢复", obj.symbol, "持仓均价:", obj.holdPrice, "持仓数量:", obj.holdAmount)

obj.status.vm = [obj.marketPosition]

} else {

obj.marketPosition = 0

obj.holdPrice = 0

obj.holdAmount = 0

obj.holdProfit = 0

}

obj.holdProfit = 0

obj.lastErr = ""

obj.lastErrTime = ""

}

// 更新状态,返回用于显示的状态数据

obj.Status = function() {

obj.status.marketPosition = obj.marketPosition

obj.status.holdPrice = obj.holdPrice

obj.status.holdAmount = obj.holdAmount

obj.status.lastPrice = obj.lastPrice

if (obj.lastPrice > 0 && obj.holdAmount > 0 && obj.marketPosition !== 0) {

// 计算收益

obj.status.holdProfit = _N((obj.lastPrice - obj.holdPrice) * obj.holdAmount * symbolDetail.VolumeMultiple, 4) * (obj.marketPosition > 0 ? 1 : -1)

} else {

obj.status.holdProfit = 0

}

return obj.status

}

// 处理交易的逻辑层面,设置交易任务的函数

obj.setTask = function(action, amount, onFinish) {

obj.task.init = false

obj.task.retry = 0

obj.task.action = action

obj.task.preAmount = 0

obj.task.preCost = 0

obj.task.amount = typeof(amount) === 'number' ? amount : 0

obj.task.onFinish = onFinish

if (action == ACT_IDLE) {

obj.task.desc = "空闲"

obj.task.onFinish = null

} else {

if (action !== ACT_COVER) {

obj.task.desc = (action == ACT_LONG ? "加多仓" : "加空仓") + "(" + amount + ")"

} else {

obj.task.desc = "平仓"

}

Log("接收到任务", obj.symbol, obj.task.desc)

// process immediately

obj.Poll(true)

}

}

// 处理交易任务的函数

obj.processTask = function() {

var insDetail = exchange.SetContractType(obj.symbol)

if (!insDetail) {

return ERR_SET_SYMBOL

}

var SlideTick = 1

var ret = false

if (obj.task.action == ACT_COVER) {

var hasPosition = false

do {

if (!$.IsTrading(obj.symbol)) {

return ERR_NOT_TRADING

}

hasPosition = false

var positions = exchange.GetPosition()

if (!positions) {

return ERR_GET_POS

}

var depth = exchange.GetDepth()

if (!depth) {

return ERR_GET_DEPTH

}

var orderId = null

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType !== obj.symbol) {

continue

}

var amount = Math.min(insDetail.MaxLimitOrderVolume, positions[i].Amount)

if (positions[i].Type == PD_LONG || positions[i].Type == PD_LONG_YD) {

exchange.SetDirection(positions[i].Type == PD_LONG ? "closebuy_today" : "closebuy")

orderId = exchange.Sell(_N(depth.Bids[0].Price - (insDetail.PriceTick * SlideTick), 2), Math.min(amount, depth.Bids[0].Amount), obj.symbol, positions[i].Type == PD_LONG ? "平今" : "平昨", 'Bid', depth.Bids[0])

hasPosition = true

} else if (positions[i].Type == PD_SHORT || positions[i].Type == PD_SHORT_YD) {

exchange.SetDirection(positions[i].Type == PD_SHORT ? "closesell_today" : "closesell")

orderId = exchange.Buy(_N(depth.Asks[0].Price + (insDetail.PriceTick * SlideTick), 2), Math.min(amount, depth.Asks[0].Amount), obj.symbol, positions[i].Type == PD_SHORT ? "平今" : "平昨", 'Ask', depth.Asks[0])

hasPosition = true

}

}

if (hasPosition) {

if (!orderId) {

return ERR_TRADE

}

Sleep(1000)

while (true) {

// Wait order, not retry

var orders = exchange.GetOrders()

if (!orders) {

return ERR_GET_ORDERS

}

if (orders.length == 0) {

break

}

for (var i = 0; i < orders.length; i++) {

exchange.CancelOrder(orders[i].Id)

Sleep(500)

}

}

}

} while (hasPosition)

ret = true

} else if (obj.task.action == ACT_LONG || obj.task.action == ACT_SHORT) {

do {

if (!$.IsTrading(obj.symbol)) {

return ERR_NOT_TRADING

}

Sleep(1000)

while (true) {

// Wait order, not retry

var orders = exchange.GetOrders()

if (!orders) {

return ERR_GET_ORDERS

}

if (orders.length == 0) {

break

}

for (var i = 0; i < orders.length; i++) {

exchange.CancelOrder(orders[i].Id)

Sleep(500)

}

}

var positions = exchange.GetPosition()

// Error

if (!positions) {

return ERR_GET_POS

}

// search position

var pos = null

for (var i = 0; i < positions.length; i++) {

if (positions[i].ContractType == obj.symbol && (((positions[i].Type == PD_LONG || positions[i].Type == PD_LONG_YD) && obj.task.action == ACT_LONG) || ((positions[i].Type == PD_SHORT || positions[i].Type == PD_SHORT_YD) && obj.task.action == ACT_SHORT))) {

if (!pos) {

pos = positions[i]

pos.Cost = positions[i].Price * positions[i].Amount

} else {

pos.Amount += positions[i].Amount

pos.Profit += positions[i].Profit

pos.Cost += positions[i].Price * positions[i].Amount

}

}

}

// record pre position

if (!obj.task.init) {

obj.task.init = true

if (pos) {

obj.task.preAmount = pos.Amount

obj.task.preCost = pos.Cost

} else {

obj.task.preAmount = 0

obj.task.preCost = 0

}

}

var remain = obj.task.amount

if (pos) {

obj.task.dealAmount = pos.Amount - obj.task.preAmount

remain = parseInt(obj.task.amount - obj.task.dealAmount)

if (remain <= 0 || obj.task.retry >= MaxTaskRetry) {

ret = {

price: (pos.Cost - obj.task.preCost) / (pos.Amount - obj.task.preAmount),

amount: (pos.Amount - obj.task.preAmount),

position: pos

}

break

}

} else if (obj.task.retry >= MaxTaskRetry) {

ret = null

break

}

var depth = exchange.GetDepth()

if (!depth) {

return ERR_GET_DEPTH

}

var orderId = null

if (obj.task.action == ACT_LONG) {

exchange.SetDirection("buy")

orderId = exchange.Buy(_N(depth.Asks[0].Price + (insDetail.PriceTick * SlideTick), 2), Math.min(remain, depth.Asks[0].Amount), obj.symbol, 'Ask', depth.Asks[0])

} else {

exchange.SetDirection("sell")

orderId = exchange.Sell(_N(depth.Bids[0].Price - (insDetail.PriceTick * SlideTick), 2), Math.min(remain, depth.Bids[0].Amount), obj.symbol, 'Bid', depth.Bids[0])

}

// symbol not in trading or other else happend

if (!orderId) {

obj.task.retry++

return ERR_TRADE

}

} while (true)

}

if (obj.task.onFinish) {

obj.task.onFinish(ret)

}

obj.setTask(ACT_IDLE)

return ERR_SUCCESS

}

// 策略逻辑执行函数

obj.Poll = function(subroutine) {

// 判断交易时段

obj.status.isTrading = $.IsTrading(obj.symbol)

if (!obj.status.isTrading) {

return

}

// 执行下单交易任务

if (obj.task.action != ACT_IDLE) {

var retCode = obj.processTask()

if (obj.task.action != ACT_IDLE) {

obj.setLastError("任务没有处理成功: " + errMsg[retCode] + ", " + obj.task.desc + ", 重试: " + obj.task.retry)

} else {

obj.setLastError()

}

return

}

// 调用Poll时如果设置了subroutine参数,只运行到此处,这个是程序设计的一个小技巧

if (typeof(subroutine) !== 'undefined' && subroutine) {

return

}

// 根据参数设置微信推送

var suffix = WXPush ? '@' : ''

// switch symbol

_C(exchange.SetContractType, obj.symbol)

// 获取K线数据

var records = exchange.GetRecords(PERIOD_D1)

if (!records) {

obj.setLastError("获取K线失败")

return

}

obj.status.recordsLen = records.length

if (records.length < 2) {

obj.setLastError("K线数据长度不足2")

return

}

// 0: IDLE 空闲, 1: LONG 做多, 2: SHORT 做空, 3: CoverALL 当前合约全部平仓。opCode 是操作码,以下策略逻辑检测到条件后设置对应的操作码

var opCode = 0

var lastPrice = records[records.length - 1].Close

obj.lastPrice = lastPrice

// 记录当日最高最低价

obj.currHigh = records[records.length - 1].High

obj.currLow = records[records.length - 1].Low

obj.status.currHigh = obj.currHigh

obj.status.currLow = obj.currLow

// 计算阻力位、支撑位

obj.records = records

var preBar = records[records.length - 2]

obj.pivot = (preBar.High + preBar.Low + preBar.Close) / 3

obj.resistancePrice1 = 2 * obj.pivot - preBar.Low

obj.resistancePrice2 = obj.pivot + (preBar.High - preBar.Low)

obj.resistancePrice3 = preBar.High + 2 * (obj.pivot - preBar.Low)

obj.strutPrice1 = 2 * obj.pivot - preBar.High

obj.strutPrice2 = obj.pivot - (preBar.High - preBar.Low)

obj.strutPrice3 = preBar.Low - 2 * (preBar.High - obj.pivot)

// 更新obj.status

obj.status.pivot = obj.pivot

obj.status.resistancePrice1 = obj.resistancePrice1

obj.status.resistancePrice2 = obj.resistancePrice2

obj.status.resistancePrice3 = obj.resistancePrice3

obj.status.strutPrice1 = obj.strutPrice1

obj.status.strutPrice2 = obj.strutPrice2

obj.status.strutPrice3 = obj.strutPrice3

// 下午收盘清仓

if (new Date().getHours() == 14 && new Date().getMinutes() > 58 && obj.marketPosition != 0) {

// 设置回调,清空保存的持久化数据

obj.setTask(ACT_COVER, 0, function(ret) {

obj.reset()

_G(obj.symbol, null)

})

obj.isBannedTrade = true

return

}

// 临近收盘禁止开仓

if (records[records.length - 1].Time != obj.preBarTime) {

obj.isBannedTrade = false

}

if (obj.isBannedTrade) {

return

}

// 策略逻辑

// 不持仓时

if (obj.marketPosition === 0) {

// 根据交易逻辑赋值opCode信号,程序后续根据信号处理

if(lastPrice > obj.resistancePrice3 || obj.backhand > 0) {

opCode = 1

} else if (lastPrice < obj.strutPrice3 || obj.backhand < 0) {

opCode = 2

}

// 反手后重置

if (obj.backhand != 0) {

obj.backhand = 0

}

} else {

if(obj.marketPosition > 0 && (obj.currHigh > obj.resistancePrice2 && lastPrice < obj.resistancePrice1 || lastPrice < obj.strutPrice3)) { // 持多仓

opCode = 3

// 平仓后反手做空

obj.backhand = -1

} else if (obj.marketPosition < 0 && (obj.currLow < obj.strutPrice2 && lastPrice > obj.strutPrice1 || lastPrice > obj.resistancePrice3)) { // 持空仓

opCode = 3

// 平仓后反手做多

obj.backhand = 1

}

}

// 如果不触发任何条件,操作码为0,返回

if (opCode == 0) {

return

}

// 执行平仓

if (opCode == 3) {

obj.setTask(ACT_COVER, 0, function(ret) {

obj.reset()

_G(obj.symbol, null)

})

return

}

var account = _bot.GetAccount()

var canOpen = parseInt((account.Balance-obj.keepBalance) / (opCode == 1 ? obj.symbolDetail.LongMarginRatio : obj.symbolDetail.ShortMarginRatio) / (lastPrice * 1.2) / obj.symbolDetail.VolumeMultiple)

var unit = Math.min(1, canOpen)

// 设置交易任务

obj.setTask((opCode == 1 ? ACT_LONG : ACT_SHORT), unit, function(ret) {

if (!ret) {

obj.setLastError("下单失败")

return

}

obj.holdPrice = ret.position.Price

obj.holdAmount = ret.position.Amount

obj.marketPosition += opCode == 1 ? 1 : -1

obj.status.vm = [obj.marketPosition]

_G(obj.symbol, obj.status.vm)

})

}

// 增加图表结构

obj.objChart = {

__isStock: true,

extension: {

layout: 'single',

height: 600,

},

title : { text : obj.symbol},

yAxis: {

plotLines: [

{value: 0,color: 'red',width: 1,label: {text: '阻力1',align: 'center'}},

{value: 0,color: 'red',width: 1,label: {text: '阻力2',align: 'center'}},

{value: 0,color: 'red',width: 1,label: {text: '阻力3',align: 'center'}},

{value: 0,color: 'green',width: 1,label: {text: '支撑1',align: 'center'}},

{value: 0,color: 'green',width: 1,label: {text: '支撑2',align: 'center'}},

{value: 0,color: 'green',width: 1,label: {text: '支撑3',align: 'center'}},

]

},

xAxis: { type: 'datetime'},

series : [

{

type: 'candlestick',

name: 'k',

id: 'k',

data: []

}

]

}

// 新增画图函数

obj.PlotRecords = function(chart) {

var r = obj.records

if(!r || r.length < 2) {

return

}

for (var j = 0; j < r.length; j++) {

if (r[j].Time == obj.preBarTime) {

chart.add(obj.index, [r[j].Time, r[j].Open, r[j].High, r[j].Low, r[j].Close], -1)

} else if (r[j].Time > obj.preBarTime) {

obj.preBarTime = r[j].Time

chart.add(obj.index, [r[j].Time, r[j].Open, r[j].High, r[j].Low, r[j].Close])

}

}

obj.objChart.yAxis.plotLines[0].value = _N(obj.resistancePrice1, 3) // 阻力1

obj.objChart.yAxis.plotLines[0].label.text = "阻力1:" + _N(obj.resistancePrice1, 3)

obj.objChart.yAxis.plotLines[1].value = _N(obj.resistancePrice2, 3)

obj.objChart.yAxis.plotLines[1].label.text = "阻力2:" + _N(obj.resistancePrice2, 3)

obj.objChart.yAxis.plotLines[2].value = _N(obj.resistancePrice3, 3)

obj.objChart.yAxis.plotLines[2].label.text = "阻力3:" + _N(obj.resistancePrice3, 3)

obj.objChart.yAxis.plotLines[3].value = _N(obj.strutPrice1, 3) // 支撑1

obj.objChart.yAxis.plotLines[3].label.text = "支撑1:" + _N(obj.strutPrice1, 3)

obj.objChart.yAxis.plotLines[4].value = _N(obj.strutPrice2, 3)

obj.objChart.yAxis.plotLines[4].label.text = "支撑2:" + _N(obj.strutPrice2, 3)

obj.objChart.yAxis.plotLines[5].value = _N(obj.strutPrice3, 3)

obj.objChart.yAxis.plotLines[5].label.text = "支撑3:" + _N(obj.strutPrice3, 3)

}

// 对象构造函数New函数的其它处理工作

var vm = null

if (RMode === 0) {

vm = _G(obj.symbol)

} else {

vm = JSON.parse(VMStatus)[obj.symbol]

}

if (vm) {

Log("准备恢复进度, 当前合约状态为", vm)

obj.reset(vm[0])

} else {

if (needRestore) {

Log("没有找到" + obj.symbol + "的进度恢复信息")

}

obj.reset()

}

return obj

}

}

function onexit() {

Log("已退出策略...")

}

function main() {

if (isReset) {

_G(null)

LogReset(1)

LogProfitReset()

LogVacuum()

Log("重置所有数据", "#FF0000")

}

if (exchange.GetName().indexOf('CTP') == -1) {

throw "只支持商品期货CTP"

}

SetErrorFilter("login|ready|流控|连接失败|初始|Timeout")

var mode = exchange.IO("mode", 0)

if (typeof(mode) !== 'number') {

throw "切换模式失败, 请更新到最新托管者!"

}

while (!exchange.IO("status")) {

Sleep(3000)

LogStatus("正在等待与交易服务器连接, " + new Date())

}

var positions = _C(exchange.GetPosition)

if (positions.length > 0) {

Log("检测到当前持有仓位, 系统将开始尝试恢复进度...")

Log("持仓信息", positions)

}

var initAccount = _bot.GetAccount()

// 恢复记录

var recoveryInitAcc = _G("initAccount")

if (!recoveryInitAcc) {

// 不存在恢复的数据,使用当前数据初始化

_G("initAccount", initAccount)

} else {

// 存在恢复的数据,恢复初始账户数据

initAccount = recoveryInitAcc

}

var initMargin = JSON.parse(exchange.GetRawJSON()).CurrMargin

var keepBalance = _N((initAccount.Balance + initMargin) * (KeepRatio/100), 3)

Log("资产信息", initAccount, "保留资金:", keepBalance)

var tts = []

var filter = []

var arr = Instruments.split(',')

for (var i = 0; i < arr.length; i++) {

var symbol = arr[i].replace(/^\s+/g, "").replace(/\s+$/g, "")

if (typeof(filter[symbol]) !== 'undefined') {

throw symbol + "已经存在,请检查参数!"

}

filter[symbol] = true

var hasPosition = false

for (var j = 0; j < positions.length; j++) {

if (positions[j].ContractType == symbol) {

hasPosition = true

break

}

}

var obj = Manager.New(hasPosition, symbol, keepBalance, Index)

tts.push(obj)

arrChart.push(obj.objChart)

// 图表数据系列索引

Index += 1

}

// 创建图表对象

var chart = Chart(arrChart)

chart.reset()

var printProfitTS = 0

var preTotalHold = -1

var lastStatus = ''

while (true) {

// 交互

var cmd = GetCommand()

if (cmd) {

if (cmd === "暂停/继续") {

Log("暂停交易中...")

while (GetCommand() !== "暂停/继续") {

Sleep(1000)

}

Log("继续交易中...")

}

Log("交互命令:", cmd)

var arr = cmd.split(":")

if(arr[0] == "cover") {

var index = parseFloat(arr[1])

// 对指定的交易所对象,执行平仓

tts[index].setTask(ACT_COVER, 0, function(ret) {

tts[index].reset()

_G(tts[index].symbol, null)

})

}

}

while (!exchange.IO("status")) {

Sleep(3000)

LogStatus("正在等待与交易服务器连接, " + new Date() + "\n" + lastStatus)

}

var tblStatus = {

type: "table",

title: "持仓信息",

cols: ["合约名称", "持仓方向", "持仓均价", "持仓数量", "持仓盈亏", "加仓次数", "当前价格", "操作"],

rows: []

}

var tblMarket = {

type: "table",

title: "运行状态",

cols: ["合约名称", "合约乘数", "保证金率", "交易时间", "柱线长度", "异常描述", "发生时间"],

rows: []

}

var totalHold = 0

var vmStatus = {}

var ts = new Date().getTime()

var holdSymbol = 0

for (var i = 0; i < tts.length; i++) {

tts[i].Poll()

var d = tts[i].Status()

if (d.holdAmount > 0) {

vmStatus[d.symbol] = d.vm

holdSymbol++

}

tblStatus.rows.push([d.symbolDetail.InstrumentName, d.holdAmount == 0 ? '--' : (d.marketPosition > 0 ? '多' : '空'), d.holdPrice, d.holdAmount, d.holdProfit, Math.abs(d.marketPosition), d.lastPrice, {'type':'button', 'cmd': 'cover:' + String(i), 'name': '平仓'}]) // 加入交互按钮

tblMarket.rows.push([d.symbolDetail.InstrumentName, d.symbolDetail.VolumeMultiple, _N(d.symbolDetail.LongMarginRatio, 4) + '/' + _N(d.symbolDetail.ShortMarginRatio, 4), (d.isTrading ? '是#0000ff' : '否#ff0000'), d.recordsLen, d.lastErr, d.lastErrTime])

totalHold += Math.abs(d.holdAmount)

// 写入画图数据

tts[i].PlotRecords(chart)

}

// 更新图表

chart.update(arrChart)

// 显示状态栏信息

var now = new Date()

var elapsed = now.getTime() - ts

var tblAssets = _bot.GetAccount(true)

var nowAccount = _bot.Account()

if (tblAssets.rows.length > 10) {

// replace AccountId

tblAssets.rows[0] = ["InitAccount", "初始资产", initAccount]

} else {

tblAssets.rows.unshift(["NowAccount", "当前可用", nowAccount], ["InitAccount", "初始资产", initAccount])

}

lastStatus = '`' + JSON.stringify([tblStatus, tblMarket, tblAssets]) + '`\n轮询耗时: ' + elapsed + ' 毫秒, 当前时间: ' + now.toLocaleString() + ', 星期' + ['日', '一', '二', '三', '四', '五', '六'][now.getDay()] + ", 持有品种个数: " + holdSymbol

if (totalHold > 0) {

lastStatus += "\n手动恢复字符串: " + JSON.stringify(vmStatus)

}

LogStatus(lastStatus)

preTotalHold = totalHold

// 定时打印一次

if (ts - printProfitTS > 1000 * 60 * 60 * 24 && !IsVirtual()) {

LogProfit(nowAccount.Info.Balance - initAccount.Info.Balance)

printProfitTS = ts

}

Sleep(LoopInterval * 1000)

}

}

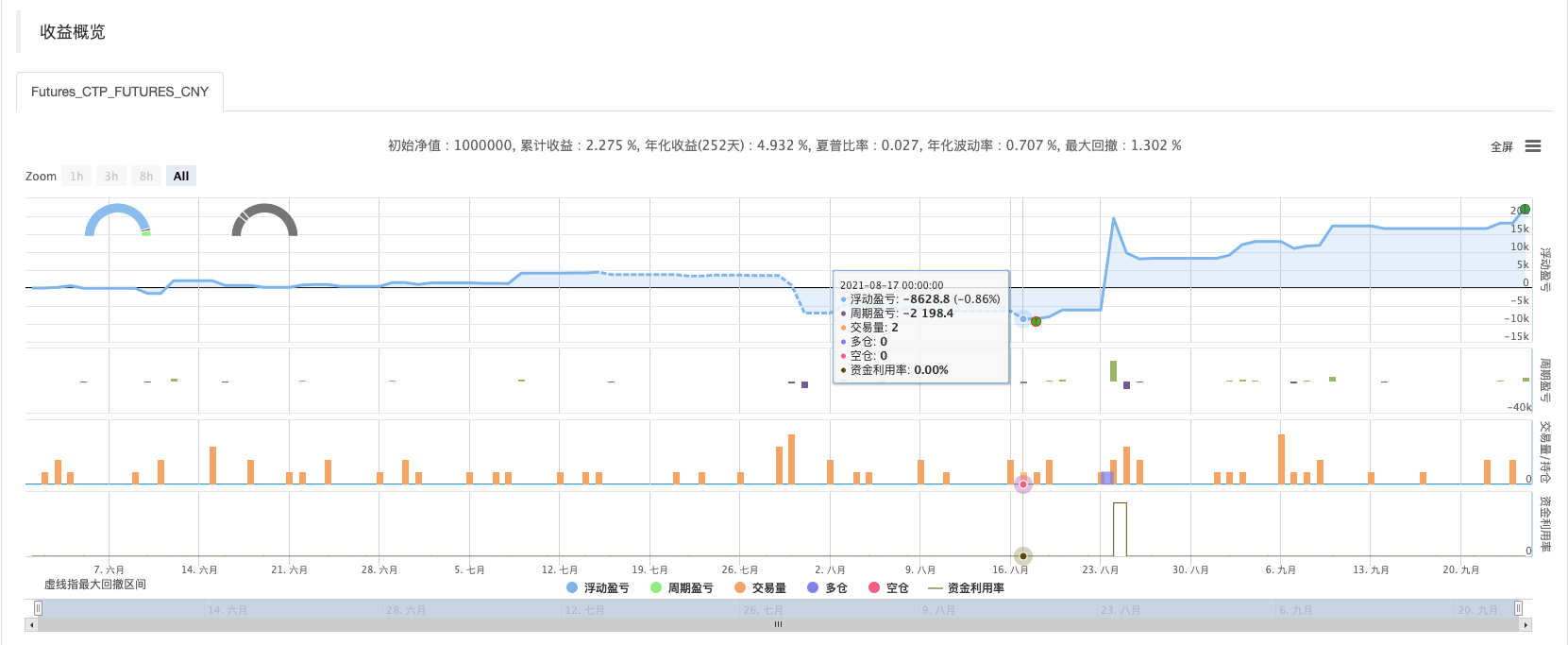

回测

相关推荐

- 股票多品种海龟交易策略设计范例

- 优宽上使用富途证券SDK选股范例与讲解

- 在优宽获取股票市场股票代码集合的实践

- 商品期货资金管理策略(教学)

- 优宽上玩转麦语言你所需要知道的事情--麦语言交易类库参数篇

- 优宽上玩转麦语言你所需要知道的事情--界面图表篇

- 商品期货等差网格策略

- 一个品种多个策略要跑怎么办——python多进程数据分发解决方案分享

- My语言策略实时推送仓位变化到手机App与微信

- 港股多品种对冲策略(2)

- 钢厂利润套利策略

- 港股多品种对冲策略(1)

- A股港股对冲套利策略(2)

- A股港股对冲套利策略(1)

- 传统模型跨期套利策略(传统商品期货)

- 零基础入门商品期货程序化交易(4)

- 优宽量化交易平台APP使用快速入门

- CTA策略之orderflow订单流策略(2)

- 零基础入门商品期货程序化交易(3)

- 零基础入门商品期货程序化交易(2)