当市场恐慌时,聪明资金在做什么?

在金融市场的血雨腥风中,当散户投资者因恐慌而疯狂抛售时,总有一群冷静的交易者在暗中布局。他们不是在追涨杀跌,而是在等待一个特殊的时刻——市场的极度恐慌。这就是Jackson Quickfingersluc(QFL)策略的核心哲学:在别人恐惧时贪婪。

QFL策略并非简单的逆向思维,而是一套精密的量化系统,它试图捕捉市场中最有价值的交易机会——恐慌性抛售后的技术性反弹。这个策略的名字来源于一位传奇交易员的绰号,他以在市场崩盘时快速抄底而闻名。

恐慌抄底的数学逻辑

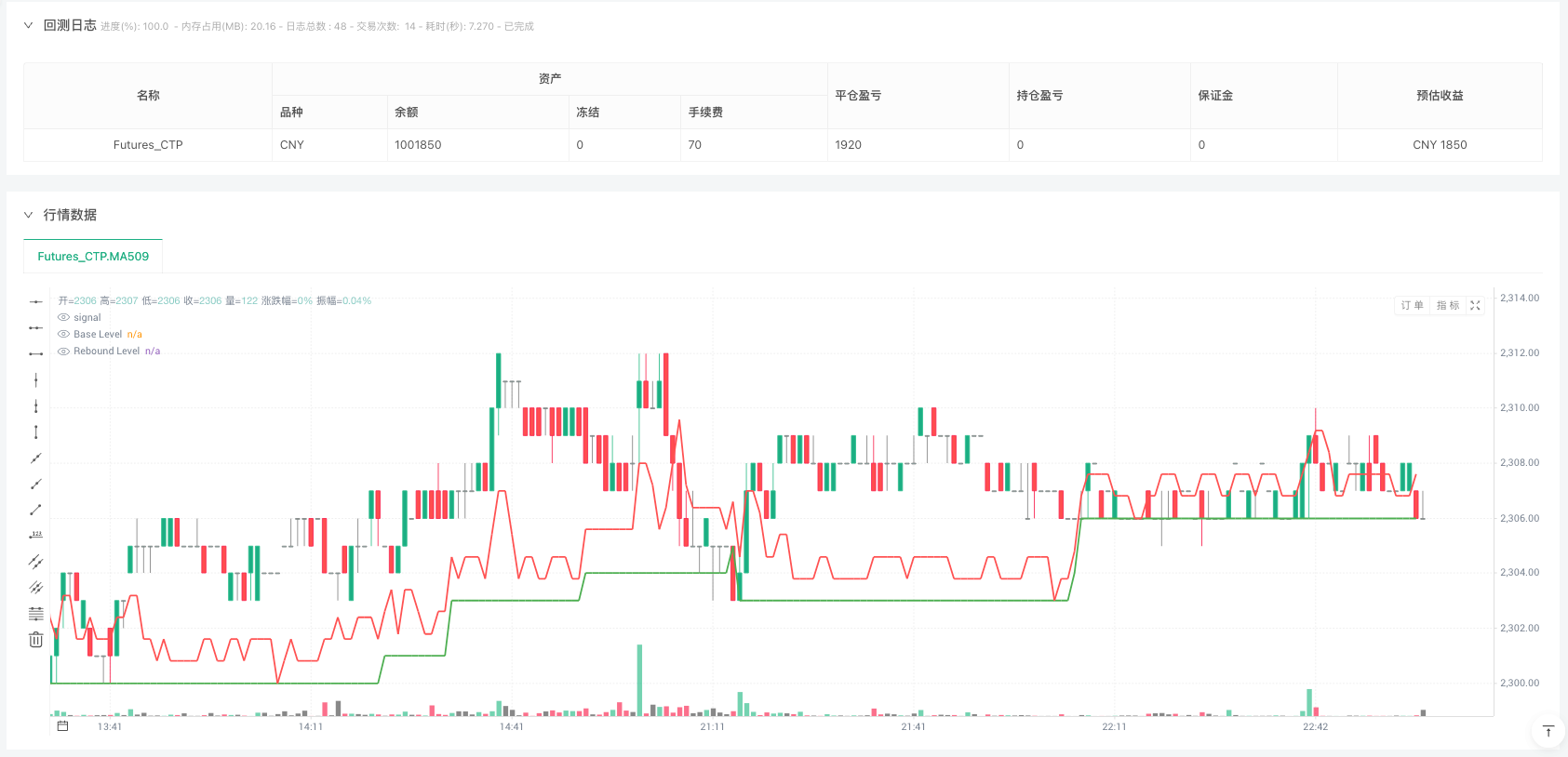

QFL策略的核心在于识别两个关键价位:基准水平(Base Level)和反弹水平(Rebound Level)。基准水平通过分析历史最低收盘价计算得出,代表了一个相对安全的支撑区域。而反弹水平则基于近期价格波动范围,为获利了结提供参考。

更为精妙的是,该策略引入了ATR(平均真实波幅)来识别恐慌性抛售。当价格波动超过ATR的特定倍数时,系统判定市场出现异常波动,这往往伴随着恐慌情绪的释放。这种设计避免了在正常市场调整中过早入场,而是专注于捕捉真正的市场失衡。

策略还设置了冷却期机制,防止在短时间内频繁交易。这个设计体现了对市场心理的深刻理解——真正的恐慌性抛售往往需要时间来充分释放,过于频繁的操作可能会错过最佳时机。

三种获利模式的智慧选择

QFL策略提供了三种不同的获利了结方式,每种都对应不同的风险偏好和市场理解:

平均价格模式适合追求稳健收益的交易者。通过计算所有持仓的平均成本,这种方式能够平滑单次交易的影响,降低时机选择的压力。

首次入场模式则更加激进,只要第一笔交易达到盈利目标就全部平仓。这种方式适合对市场时机判断有信心的交易者,能够快速锁定利润。

分批平仓模式最为精细,允许对每个独立头寸进行管理。这种方式在波动较大的市场中特别有效,能够最大化利用价格的多次反弹。

策略的市场适应性分析

从回测数据来看,QFL策略在不同市场环境下表现出了良好的适应性。在趋势性下跌市场中,策略能够捕捉到多次技术性反弹,虽然单次收益可能有限,但胜率相对较高。在震荡市场中,策略的表现更加出色,因为恐慌性抛售后的反弹往往更加迅速和明显。

然而,策略也存在明显的局限性。在强势上涨趋势中,恐慌性抛售的机会相对较少,策略的交易频率会显著下降。此外,在极端的系统性风险事件中,传统的技术分析可能失效,基准水平可能被快速击穿。

风险管理的艺术

QFL策略的风险管理体现在多个层面。首先,通过ATR动态调整恐慌识别的敏感度,使策略能够适应不同的市场波动环境。其次,冷却期机制有效防止了过度交易,保护了资金安全。

更重要的是,策略的止盈机制设计巧妙地平衡了贪婪与恐惧。通过要求同时满足盈利目标和反弹确认两个条件,策略避免了过早离场,同时也防止了利润的大幅回撤。

未来演进的思考

随着市场结构的不断变化,QFL策略也需要持续优化。机器学习技术的引入可能会提升恐慌识别的准确性,而情绪指标的结合可能会增强策略的预测能力。

此外,考虑到现代市场的高频特性,策略可能需要在更短的时间框架内运行,这就要求对参数进行相应的调整和优化。

QFL策略的真正价值不仅在于其盈利能力,更在于它所体现的交易哲学——在市场最黑暗的时刻保持理性,在众人恐惧时展现勇气。这种逆向思维的量化实现,为现代交易者提供了一个独特的视角来理解和参与金融市场。

/*backtest

start: 2025-01-01 00:00:00

end: 2025-08-26 00:00:00

period: 1m

basePeriod: 1m

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

args: [["ContractType","p2509",360008]]

*/

//@version=6

strategy("Jackson Quickfingersluc (QFL) Strategy", overlay=true)

// Parameters

baseLevelMultiplier = input.float(1, title="Base Level Multiplier", minval=0.1, maxval=1.0, step=0.05)

reboundMultiplier = input.float(0.8, title="Rebound Level Multiplier", minval=0.0001, maxval=1.0, step=0.01) // Multiplier for range of past candles

lookBackPeriod = input.int(50, title="Look-back Period", minval=10)

atrPeriod = input.int(14, title="ATR Period", minval=1)

atrMultiplier = input.float(1.2, title="Panic Sell ATR Multiplier", minval=0.1, maxval=5.0, step=0.1) // Multiplier for ATR threshold

exitProfitThreshold = input.float(0.01, title="Exit Profit Threshold", minval=0.001, maxval=0.1, step=0.001) // Minimum profit threshold (e.g., 1%)

panicSellPercentage = input.float(0.005, title="Panic Sell Percentage Below Base Level", step=0.0001) // Percentage below base level for panic sell

takeProfitOption = input.string("avg_price", title="Take Profit Option", options=["avg_price", "first_entry", "each_position"]) // TP option selection

rangeBars = input.int(3, title="Number of Bars for Range Calculation", minval=1) // Input for number of bars for range calculation

cooldownBars = input.int(5, title="Cooldown Period (Bars)", minval=1) // Input for cooldown period after a buy

// Calculate Base Level

lowestClose = ta.lowest(close, lookBackPeriod)

baseLevel = lowestClose[1] * baseLevelMultiplier

// Calculate Rebound Level as a multiplier of the range of the last 'rangeBars' bars

rangeLastBars = ta.highest(high, rangeBars) - ta.lowest(low, rangeBars)

reboundLevel = reboundMultiplier * rangeLastBars + baseLevel

// Plotting base and rebound levels

plot(baseLevel, color=color.green, linewidth=2, title="Base Level")

plot(reboundLevel, color=color.red, linewidth=2, title="Rebound Level")

// Calculate ATR

atrValue = ta.atr(atrPeriod)

// Factorial average and panic sell movement calculation

var bool panicSellMovement = false

// Loop through each range and check for panic sell condition

for bar_i = 1 to rangeBars+1

currentBarRange = high[bar_i - 1] - low[bar_i - 1] // Current bar range

rangeOfLastXBars = ta.highest(high, bar_i) - ta.lowest(low, bar_i) // Range of the last `bar_i` bars

// Condition 1: Check if the average range of the last `bar_i` bars exceeds ATR multiplier

if (rangeOfLastXBars / bar_i) > atrMultiplier * atrValue

panicSellMovement := true

break // Exit the loop immediately

// Condition 2: Check if the current bar range exceeds ATR multiplier

if currentBarRange > atrMultiplier * atrValue

panicSellMovement := true

break // Exit the loop immediately

// Define the adjusted base level threshold for panic sell (base level - percentage)

panicSellThreshold = baseLevel[0] * (1 - panicSellPercentage)

// Define panic sell condition with base level check and the panic sell percentage threshold

isPanicSell = low < panicSellThreshold and panicSellMovement

// Define rebound condition

isRebound = close > reboundLevel

// Track the last entry bar index

var float lastEntryBar = na

// Store entry prices for each position in an array

var float[] entryPrices = na

var float[] entrySizes = na

bool exit_cond = false

if (na(entryPrices))

entryPrices := array.new_float(0)

if (na(entrySizes))

entrySizes := array.new_float(0)

// Strategy to simulate buys and sells (for backtesting purposes)

entry_cond = isPanicSell and (na(lastEntryBar) or (bar_index - lastEntryBar) > cooldownBars)

if entry_cond

strategy.order("Buy", strategy.long)

lastEntryBar := bar_index // Set last entry bar to current bar index

// Store the entry price and size for this new position

array.push(entryPrices, close)

array.push(entrySizes, strategy.position_size)

// Trigger BUY alert

alert("BUY ALERT: Panic Sell condition triggered", alert.freq_once_per_bar)

isTakeProfitCondition(entryPrice) =>

profitPercentage = (close - entryPrice) / entryPrice

profitCondition = profitPercentage >= exitProfitThreshold

reboundCondition = isRebound

profitCondition and reboundCondition

// Check TP condition based on selected option

if takeProfitOption == "avg_price"

avgEntryPrice = strategy.position_avg_price

if isTakeProfitCondition(avgEntryPrice)

exit_cond := true

strategy.close("Buy")

else if takeProfitOption == "first_entry"

firstEntryPrice = strategy.opentrades.entry_price(0)

if isTakeProfitCondition(firstEntryPrice)

exit_cond := true

strategy.close("Buy")

else if takeProfitOption == "each_position"

// Ensure we only check when there is at least one entry

if array.size(entryPrices) > 0

// Loop until there are no more entries left

i = 0

while i < array.size(entryPrices)

entryPrice = array.get(entryPrices, i)

positionSize = array.get(entrySizes, i)

// Check profit condition for each position

if isTakeProfitCondition(entryPrice)

exit_cond := true

// Remove the entry price and size from the arrays once the position is closed

array.remove(entryPrices, i)

array.remove(entrySizes, i)

strategy.close("Buy", qty=positionSize) // Close only the position that reached the target

else

// Only increment the index if the current entry is not closed

i := i + 1

// Trigger SELL alert

if exit_cond

alert("SELL ALERT: Exit condition met (take profit or rebound)", alert.freq_once_per_bar)