过程 - 扫描趋势中的数据透视。这意味着,以升序或降序排列的一系列枢轴高点或枢轴低点。 - 在趋势序列中的每个枢轴之间绘制趋势线。例如,如果有5个pivot high uptrend pivot,请在每个点之间绘制mXn线。 - 选择更准确或更强的趋势线。准确度是通过接触线的蜡烛/灯芯的数量和落在线外的蜡烛的数量来衡量的。更强的趋势线将接触更多蜡烛和枢轴,溢出更少。 - 除去每个方向最精确的线以外的所有线。

在任何时候,您都可以在此脚本中看到多达4条趋势线。

- 趋势线连接处于上升状态的枢轴高点

- 趋势线连接处于上升状态的枢轴低点

- 下降趋势条件下的趋势线连接枢轴高点

- 趋势线连接下行条件下的枢轴低点

旧的线路将一直保留,直到新的线路通过相同类型的线路。因此,您仍然可以看到很久以前创建的下降趋势工具的上升和下降趋势线!!此外,只有当旧趋势线更强时,新趋势线才会取代旧趋势线(连接到更多枢轴,溢出更少)

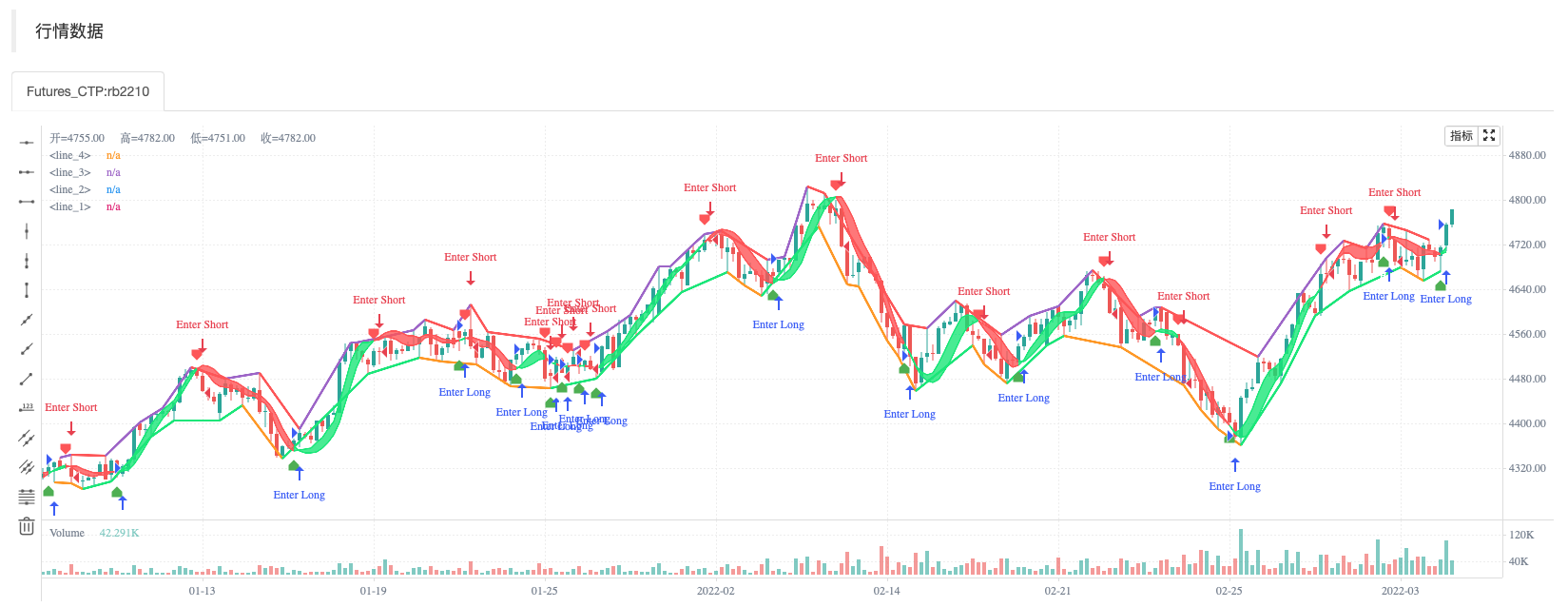

回测测试

策略源码

/*backtest

start: 2021-12-01 00:00:00

end: 2022-03-05 00:00:00

period: 1h

basePeriod: 15m

exchanges: [{"eid":"Futures_CTP","currency":"FUTURES"}]

args: [["ContractType","rb2210",360008]]

*/

//@version=4

study("BRAHMASTRA", precision=2, overlay=true)

// compilation: capissimo

// This script utilizes two modules, Trendlines Module (by Joris Duyck) and HMA-Kahlman Trend Module.

// Trendlines module produces crossovers predictive of the next local trend.

//*** HMA-Kahlman Trend Module

price = input(hl2, "价格数据(默认hl2)")

hkmod = input(true, "===HMA-Kahlman 趋势模型===")

length = input(22, "回看窗口周期", minval=2)

k = input(true, "使用Kahlman")

gain = input(.7, "赢得", minval=.0001, step=.01)

labels = input(true, "显示标签?")

o = input(true, "使用偏移")

hma(x, p) => wma((2 * wma(x, p / 2)) - wma(x, p), round(sqrt(p)))

hma3() => p = length/2, wma(wma(close, p/3)*3 - wma(close, p/2) - wma(close, p), p)

kahlman(x, g) =>

kf = 0.0

dk = x - nz(kf[1], x)

smooth = nz(kf[1],x)+dk*sqrt(g*2)

velo = 0.0

velo := nz(velo[1],0) + (g*dk)

kf := smooth+velo

a = k ? kahlman(hma(price, length), gain) : hma(price, length)

b = k ? kahlman(hma3(), gain) : hma3()

c = b > a ? color.lime : color.red

crossdn = a > b and a[1] < b[1]

crossup = b > a and b[1] < a[1]

ofs = o ? -1 : 0

fill(plot(a,color=c,linewidth=1,transp=75), plot(b,color=c,linewidth=1,transp=75), color=c, transp=55)

plotshape(labels and crossdn ? a : na, location=location.abovebar, style=shape.labeldown, color=color.red, size=size.tiny, text="S", textcolor=color.white, transp=0, offset=ofs)

plotshape(labels and crossup ? a : na, location=location.belowbar, style=shape.labelup, color=color.green, size=size.tiny, text="B", textcolor=color.white, transp=0, offset=ofs)

//*** Trendlines Module, see https://www.tradingview.com/script/mpeEgn5J-Trendlines-JD/

tlmod = input(true, "===趋势线模型===")

l1 = input(2, "枢轴点回看窗口周期", minval=1)

trendline(input_function, delay, only_up) => // Calculate line coordinates (Ax,Ay) - (Bx,By)

var int Ax = 0, var int Bx = 0, var float By = 0.0, var float slope = 0.0

Ay = fixnan(input_function)

if change(Ay)!=0

Ax := time[delay], By:= Ay[1], Bx := Ax[1]

slope := ((Ay-By)/(Ax-Bx))

else

Ax := Ax[1], Bx := Bx[1], By := By[1]

var line trendline=na, var int Axbis=0, var float Aybis=0.0, var bool xtend=true

extension_time = 0

Axbis := Ax + extension_time

Aybis := (Ay + extension_time*slope)

if tlmod and change(Ay)!=0

line_color = slope*time<0?(only_up?na:color.red):(only_up?color.lime:na)

if not na(line_color)

trendline = line.new(Bx,By,Axbis, Aybis, xloc.bar_time, extend=xtend?extend.right:extend.none, color=line_color, style=line.style_dotted, width=1)

line.delete(trendline[1])

slope

pivot(len) =>

high_point = pivothigh(high, len,len/2)

low_point = pivotlow(low, len,len/2)

slope_high = trendline(high_point, len/2,false)

slope_low = trendline(low_point, len/2,true)

[high_point, low_point, slope_high, slope_low]

[high_point1, low_point1, slope_high1, slope_low1] = pivot(l1)

color_high1 = slope_high1 * time<0 ? color.red : na

color_low1 = slope_low1 * time>0 ? color.lime : na

plot(tlmod ? high_point1 : na, color=color_high1, offset=-l1/2, linewidth=2)

plot(tlmod ? low_point1 : na, color=color_low1, offset=-l1/2, linewidth=2)

if crossup

strategy.entry("Enter Long", strategy.long)

else if crossdn

strategy.entry("Enter Short", strategy.short)

相关推荐